The cap table or capitalization table is an extremely important component to consider for both the founders and investors. The cap table is a table that shows ownership or in financial terms equity capitalization of a company. As basics go, a cap table is very easy to understand. It is a table that shows all the shareholders of the company and how much of the company each person or entity owns. However, managing the cap-table and its evolution is a complicated matter which could take up a lot of time and effort to understand. Improper management of the cap table could have repercussions for financial decisions and future fund-raises.

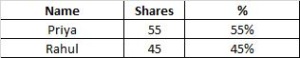

Let us take up a simple example to understand. NewLabs Private Limited (NewLabs), a startup based out of Bangalore is incorporated with 2 founders Priya and Rahul each owning 55% and 45% of the company respectively. Below is how the cap table looks to start with.

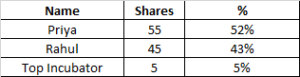

Few months pass by and after a few conversations the founders agree to be incubated by Top Incubator, one of the best accelerators in the country. In exchange for office space, utilities, connections to investors, strategic partners and a low-cost loan of Rs.25 Lakhs, the startup has to part with 5% equity, which feels like a good deal to the founders, and they decide to go ahead.

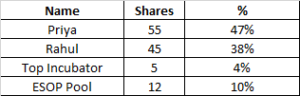

Following so far? Great. Eight months go by, and NewLabs has progressed well. After a few paid pilots with Fortune 500 companies, they land their first blue chip customer. Additionally they have filed for a patent on their product. On the back of this positive news, NewLabs has gotten a term-sheet for their seed round from Angels of India, a large well-connected network of angels, consisting of many top industrialists. It is apparent that the connections from the investors of Angels of India could be very useful to NewLabs as well. Before investing however, Angels of India has a condition precedent that the company should create an ESOP pool of 10%, which can be used to hire good candidates in the future to beef up the team. The cap table will now looks like:

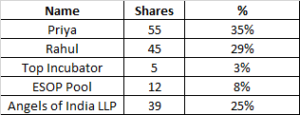

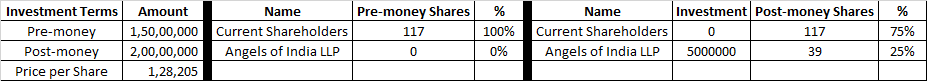

After multiple rounds of negotiation, Angels of India have agreed to invest INR 50 Lakhs in NewLabs’ seed round at a pre-money valuation of INR 1.5 Cr, for a total valuation of INR 2 Cr post-money. While Angels of India are a network of High-Net-Worth individuals, they invest via an LLP structure which ensures that only one entity shows up on the cap-table reducing clutter and makes it easier for the founders to manage investor relationships and future decision making. This would give Angels of India a 25% stake in the company. The cap-table now looks below:

The last case is the first time in the evolution of NewLabs that shares are being purchased and a price per share calculation has been worked out. Let us look at the cap table in greater detail with regards to the last transaction.

The key terms of the investment – pre-money valuation, investment amount, post-money valuation, price-per-share, ownership percentages pre and post-money are all easily understood in the above table.

Once a pre-money valuation has been agreed upto, the price-per-share is automatically calculated. The pre-money valuation of INR 1.5 Cr means that the 117 shares that are currently outstanding of NewLabs in total are worth INR 1.5 Cr, essentially giving us a price per share of INR 128205 (15000000/117). The new investors at this point are infusing further capital of INR 50 Lakhs at the same price of INR 128205 per share giving them a further 39 shares (5000000/128205) in NewLabs. These 39 shares translate into an ownership of 25% on the cap table of NewLabs. This will bring us to the very important but inherently simple formula:

Pre-money Valuation + Investment Amount = Post-money Valuation

Other important formulae connected to the cap table above:

Price-Per-Share = Pre-money valuation / Pre-money shares outstanding

Post-money shares outstanding = Post-money valuation / Price-Per-Share

As a company continues to raise more capital, the cap table will continue getting more complicated depending on the terms of the new agreements and instruments used to raise the funds. Understandably, figuring out the ownership would not be as easy as presented above, and we can dive into it in further detail in future posts.